Diluted earnings per share formula

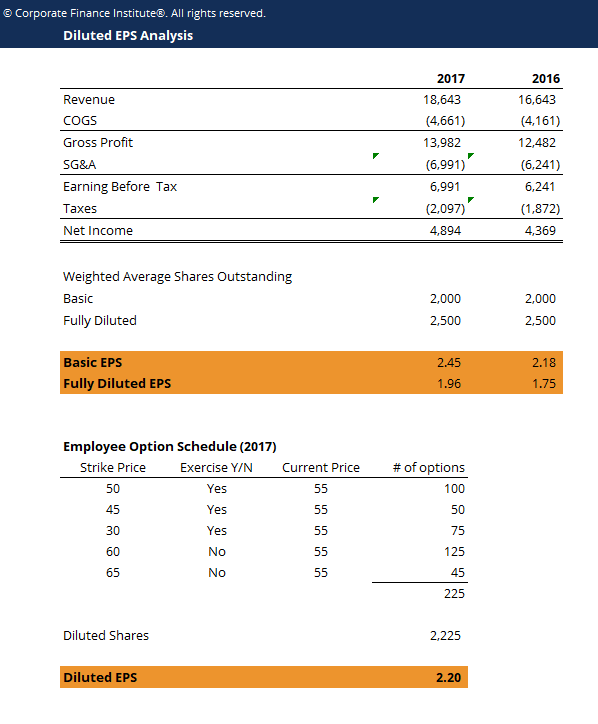

We then divide the 250mm of net earnings for common equity by our new dilution-adjusted. 100 x 5-2 5 60 Solution Basic EPS Convertible Loan Share options E 100 28 S 50 160 60 Diluted EPS.

Calculating Diluted Earnings Per Share

Fully Diluted Common Shares Outstanding 200mm Common Shares 51mm 251mm.

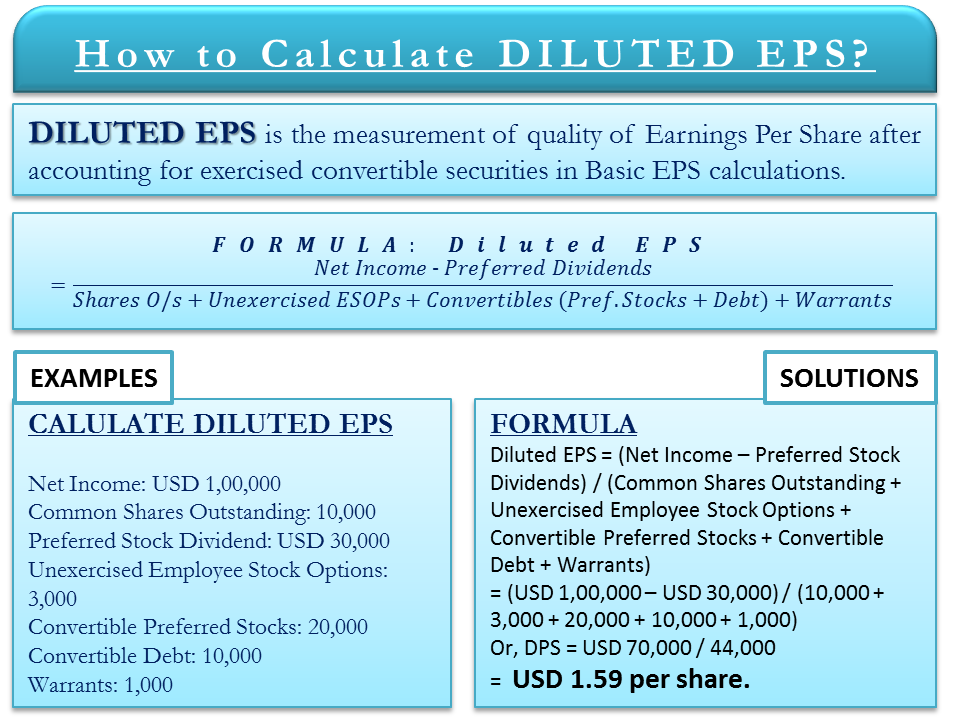

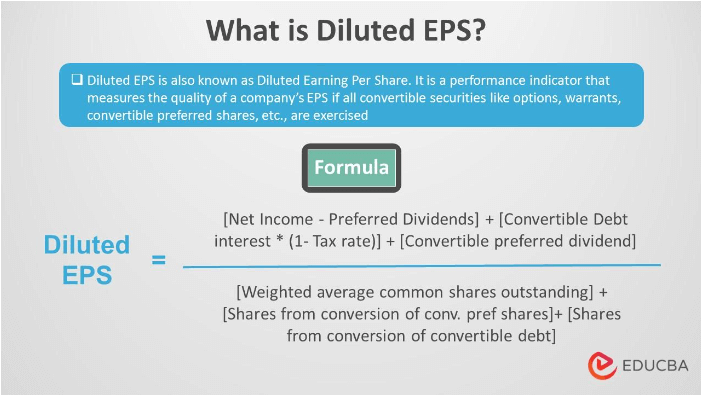

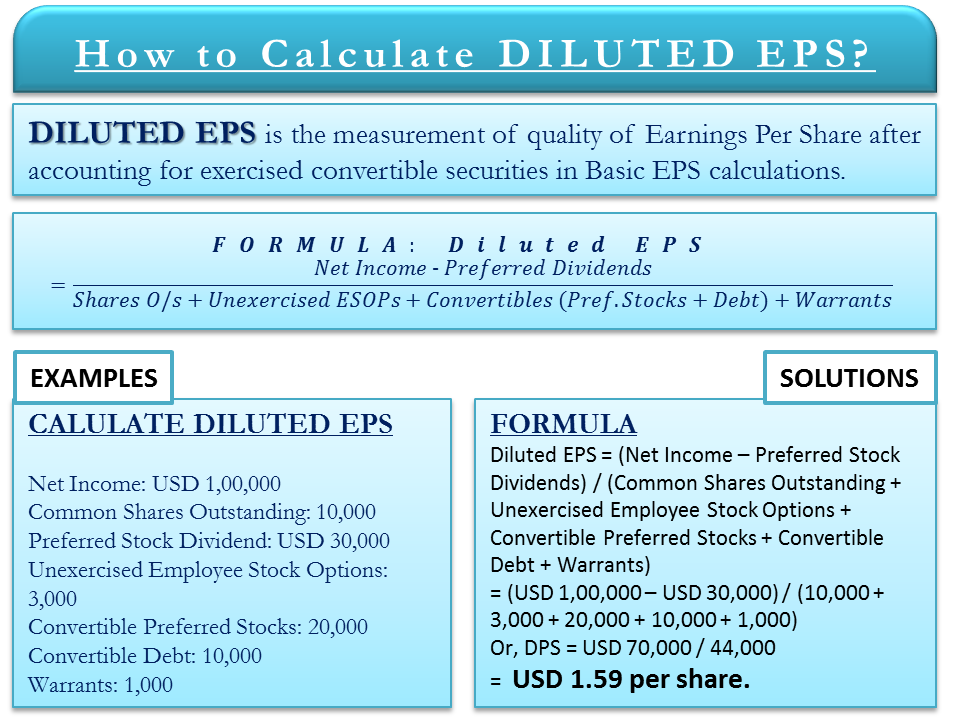

. Diluted Earnings per Share Formula Net Income Preferred Stock Dividends Common Shares Outstanding Unexercised Employee Stock Options Convertible Preferred Stocks. To calculate diluted EPS take a companys net income and subtract any preferred dividends then divide the result by the sum of the weighted average number of shares. An alternative calculation is.

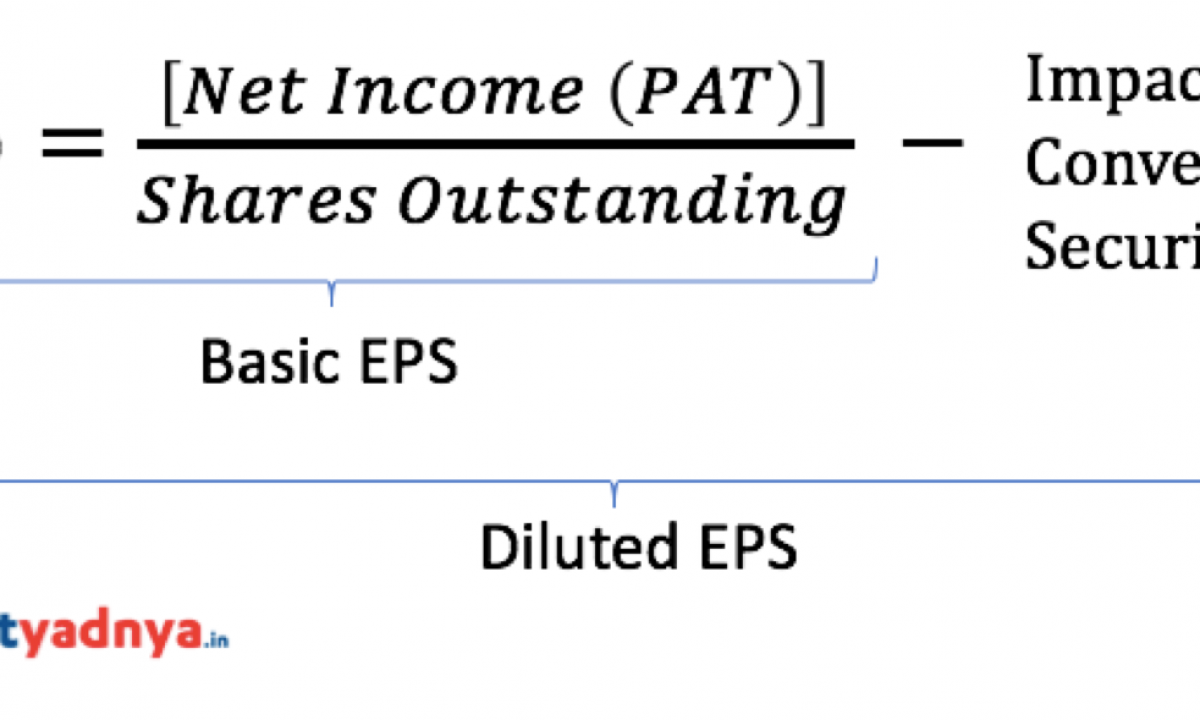

Basic EPS measures how much a company earns per share by dividing the net income minus the preferred dividend with the number of outstanding equity shares while diluted EPS takes into. It is calculated by taking the companys net income for the period in question and dividing it by the. To calculate diluted EPS we start by adding those diluted shares 50 million 150 million 200 million to the 200 million outstanding shares to get a denominator of 400 million.

As the name implies diluted earnings per share present the lowest possible earnings per share based on assumptions that all possible shares are issued. Profit or loss attributable to common equity holders of. Public companies are required to report their primary earnings.

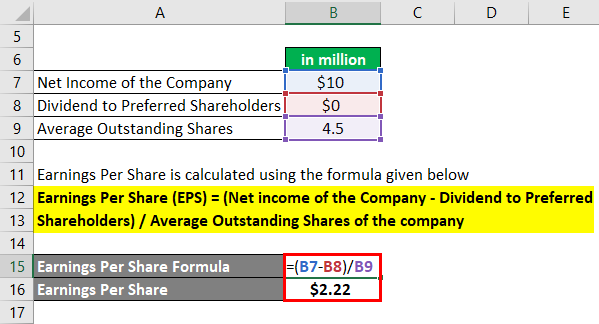

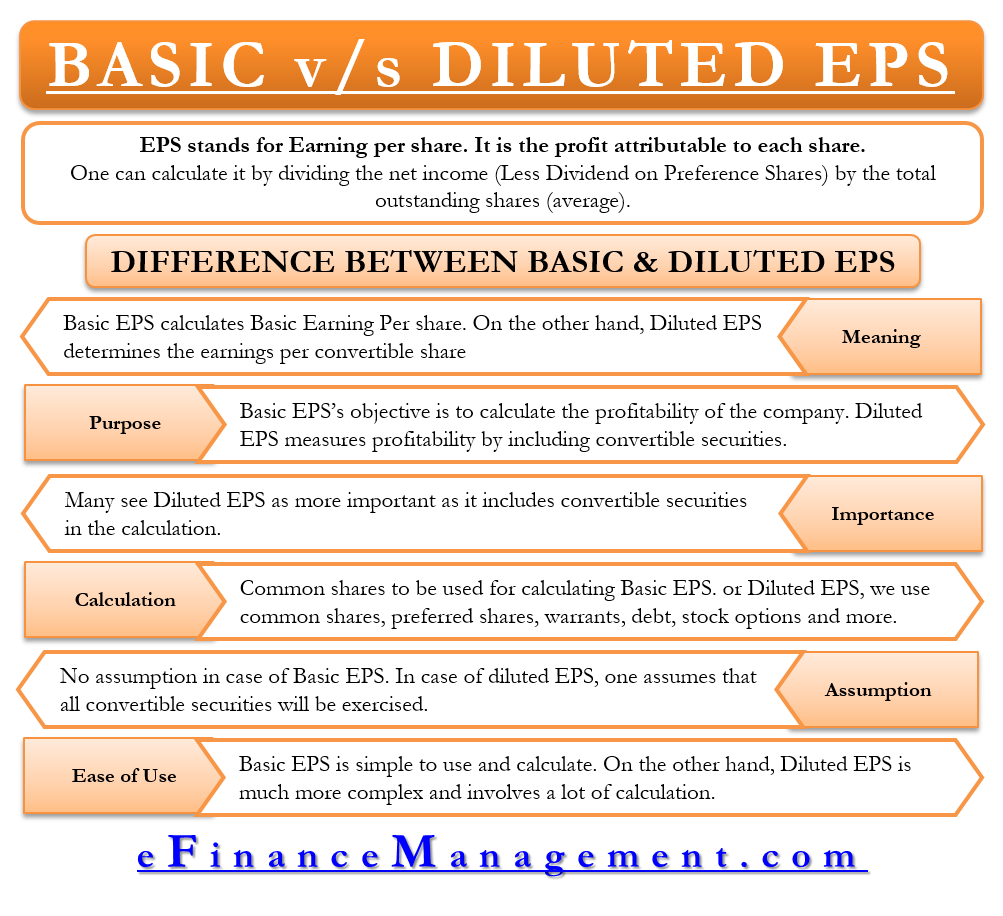

Diluted EPS is a common financial metric or profitability calculation used to gauge a companys financial health. We use this figure in the diluted eps calculation. Earnings per Share EPS is a metric that is used to measure a companys profitability.

The value of earnings per share if all convertible securities were actually converted to common shares is called diluted earnings per share in short EPS. This dilution may affect the profit or loss in the numerator of the dilutive earnings per share calculation. Diluted EPS Net Income - Preferred Dividends Weighted Average Number of Shares Outstanding Diluted Shares Diluted EPS 1000000 - 20000 11000 545.

To calculate diluted shareholding we are required to calculate Existing Shareholding. Earnings per share income from continuing operations preferred dividends weighted average common shares Diluted earnings per share edit Diluted earnings per share diluted EPS is a. Existing Shareholding 50010000 5 Whereas Diluted Shareholding is.

Diluted Earnings per Share Formula 80000 15000 10000 8000 65000 18000 361 per share Assume that the company does not have any convertibles or. Both IFRS and US GAAP require a company to present its earnings per share EPS on the face of the income statement for net profit or loss net income and profit or loss. It is calculated and reported in.

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Diluted Eps Formula Example Calculate Diluted Earnings Per Share

Diluted Eps Earnings Per Share Meaning Formula Examples

Earnings Per Share Formula Eps Calculator With Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-02-46d614bf6401446d8a68276252797a11.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Basic Vs Diluted Eps All You Need To Know

What Does It Mean When Eps Is Diluted Universal Cpa Review

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Diluted Eps Prepnuggets

/dotdash_Final_Earnings_Per_Share_EPS_vs_Diluted_EPS_Whats_the_Difference_Dec_2020-01-7cc050483472487f95e4bbe119e8d554.jpg)

Earnings Per Share Eps Vs Diluted Eps What S The Difference

Calculation Of Diluted Eps Convertible Preferred Stock Finance Train

Share Dilution Meaning Calculation Example Diluted Eps Protection

How To Calculate Diluted Eps Formula Example Importance Efm

Diluted Earnings Per Share Eps Formula And Excel Calculator

Diluted Earnings Per Share Eps Formula And Excel Calculator

Simplifying Eps

What Is Earning Per Share Eps Basic Vs Diluted Eps Yadnya Investment Academy